A tax on CCU is a tax on you.

Federal lawmakers are working on tax reforms. This includes the potential removal of the not-for-profit designation for credit unions. At Commonwealth Credit Union, maintaining our tax-exempt status is crucial for continuing to provide affordable, member-focused financial services. The "Don't Tax My Credit Union (Opens in a new Window)" movement is a way to rally and protect the unique role that credit unions play in supporting the communities we call home.

Why Commonwealth Credit Union is Not-for-Profit

Credit Unions are structured differently from banks. These unique differences are what warrant the income tax exemption:

- Your money goes back to supporting you. Unlike banks that pay stockholders, we reinvest earnings to benefit members.

- We are led by a volunteer board elected by our members, ensuring that decisions are made with your best interests in mind.

- Don’t be misled, Credit Unions do pay taxes. We proudly support Kentucky communities by paying property taxes for our 17 branches, payroll taxes for our 370+ employees, and hiring locally to strengthen our economy.

What This Means for YOU

- Lower Loan Rates – From our First-Time Homebuyer program to low auto and personal loans, we offer rates to help you borrow smarter. Our Skip A Payment program lets you pause a loan payment when life demands it—just last year, we approved 3,440 Skip A Pay requests, totaling $1,250,000 in skipped payments. Plus, our balance transfer option helps you say goodbye to high-interest credit cards with no balance transfer fee.

- Higher Savings Rates – Accounts like our Round UP Checking lets you save while you spend, rounding up transactions and automatically transferring the difference into savings with matching support provided by CCU.

plus...

- Free Checking Accounts – Managing your money should be simple, and with Commonwealth Credit Union's free checking accounts with no hidden fees, it is.

- Reduced Fees – We believe in keeping more of your money where it belongs—with you. That’s why we offer little to no fees on our products, ensuring you can manage your finances without unnecessary costs.

- Financial Education – We believe strong financial futures start with knowledge. That’s why we offer free financial literacy programs for our members and provide schools with complimentary educational platforms, helping students build smart money habits early on.

What’s at Stake?

Taxing Commonwealth Credit Union could:

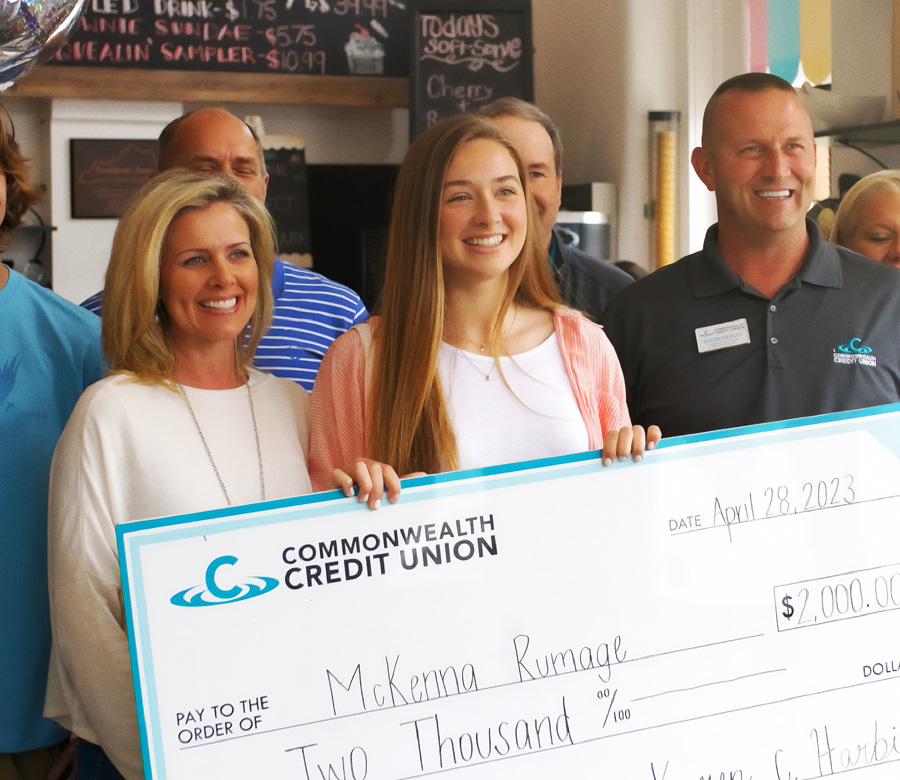

- Reduce Our Community Support: Local programs, scholarships, and charitable initiatives could see cuts. In 2023 alone, we gave back over $29 million in community giving, supporting the people and programs that make a difference.

- Threaten Our Member-Focused Mission: Credit unions exist to serve members, not shareholders. Taxation would compromise this core principle.

- Raise Costs for Our Members: You could see inevitably higher fees and loan rates, along with other changes to the products and services you depend on.

Why We Need Your Support

More than 140 million Americans choose credit unions, and 43% of all Americans belong to one. At Commonwealth Credit Union, we are committed to putting people over profits. That’s why we not only offer competitive financial products but also invest in our communities—sponsoring local events, partnering with Baptist Health, Make-A-Wish, the American Heart Association, and the YMCA to promote wellness, and more. But if Congress decides to tax credit unions all of this could change.THE FACTS

55% of credit union members view themselves as members instead of customers.

140 M

Americans are served by credit unions.

Take Action Today: Protect YOUR Credit Union

We need your help to ensure lawmakers understand the importance of credit unions to their communities. By speaking up, you can protect the benefits you enjoy as a member of Commonwealth Credit Union.

Here’s how you can help:

- Contact Your Legislators: Make your voice heard by reaching out to your U.S.Representative and Senators.

- Senator Mitch McConnell Jr. (Opens in a new Window)

- Senator Rand Paul (Opens in a new Window)

- Representative Andy Barr IV (Opens in a new Window)

- Representative Thomas Massie (Opens in a new Window)

- Representative James Comer (Opens in a new Window)

- Representative Hal Rogers (Opens in a new Window)

- Representative Morgan McGarvey (Opens in a new Window)

- Representative Brett Guthrie (Opens in a new Window)

- Tell Them: “Don’t tax my credit union! ” by copying and pasting this as your message:

-

"I am Writing to you as a member of Commonwealth Credit Union, headquartered in Frankfort, Kentucky.

Big banks and their allies in Washington are pushing you to eliminate the credit union tax exemption. As a taxpayer who depends on my credit union, I urge Congress to keep its hands off the credit union tax exemption.

Congress passed the Federal Credit Union Act during the Great Depression when banks refused to serve working Americans. Credit unions provide alternatives so families, farmers, small business owners, and others left behind by banks have financial options. Through the years, credit unions have adapted to meet the evolving needs of their members. But one thing that hasn’t changed is credit unions’ focus to provide access to credit through locally owned partnerships that reinvest earnings in their members, not Wall Street investors.Please don't hurt me and my credit union by changing the credit union tax exemption in any tax reform bill. Don't tax me and my credit union!"

-

- Share Your Story: Add to the message by telling your legislators how Commonwealth Credit Union has positively impacted your life! Whether it’s helping you buy your first home, providing financial education, or supporting your community, your personal experience can make a powerful statement.