Manage your money any way you like

Sure, you use your checking account to pay your bills and cover other expenses. But every time you use your debit card, you could actually be saving money at the same time you're spending it.

Sure, you use your checking account to pay your bills and cover other expenses. But every time you use your debit card, you could actually be saving money at the same time you're spending it.- Every debit transaction will be “rounded up” to the next whole dollar amount and deposited into your Round UP Savings account, which earns 5.00% APY*

- We’ll match 100% of the rounded up transfers for the first 90 days and 5% annually thereafter for a maximum of $250 per year*

- Free Visa debit card that you can connect to your mobile wallet for quicker, more secure transactions

- Unlimited access to Digital Banking and Mobile App**

- Withdraw money at a nationwide network of 135,000 surcharge-free ATMs

- Overdraft Protection*** and Overdraft Privilege****

- Reorder checks easily through Deluxe

* Annual Percentage Yield. Rate effective as of January 1, 2025. For the first 90 days after you are enrolled in the program, the Credit Union will match 100% of the rounded-up transfers for a maximum of $250. After the first 90-day period, the Credit Union will match 5% of the rounded-up transfers, for a maximum cumulative contribution of $250 annually. The round up match will be paid at the end of the first 90 days. The 5% match will be paid annually on the first business day after your anniversary of account opening. Rates may change after the account is opened. Fees could reduce earnings on the account. Online Banking and eStatement are required.

** Data and other wireless carrier charges may apply.

***You can choose to have funds transferred from your savings account or additional checking account to cover amounts more than your available balance.

**** Overdraft Privilege is a discretionary overdraft service, requiring no action on your part, that provides you a safety net up to an automatically assigned overdraft limit. Your Overdraft Privilege Intelligent limit may be available for checks and other transactions made using your checking account number, such as an automatic (ACH) payment transaction, automatic bill payment or recurring debit card payment. If you request us to do so (opt in), we may authorize ATM transfers or withdrawals and everyday debit card purchases using your available balance and your Overdraft Privilege limit. For business accounts the limit may be available for ATM and everyday debit card transactions with no action required. Balances displayed do not include the Overdraft Privilege limit. There is no additional cost associated with Overdraft Privilege unless you use it. If you do use the Overdraft Privilege limit, you will be charged our paid item OD Privilege fee of $32 for each overdrawn item created by checks and other transactions made using your checking account number, such as an automatic payment (ACH) transaction, automatic bill payment, or recurring debit card payment. For Overdraft Privilege consideration, your account is in “good standing” if you (1) make sufficient deposits to bring your account to a positive end-of-day balance at least once every 30 calendar days (including the payment of all credit union fees and charges); (2) avoid excessive overdrafts suggesting the use of Overdraft Privilege as a continuing line of credit; and (3) have no legal orders, levies or liens against your account.

Power Checking is an all-in-one checking account that powers your spending, and with built in high-yield savings, grows your balance at the same time. No minimums, no limits - only unparalleled benefits.

Power Checking is an all-in-one checking account that powers your spending, and with built in high-yield savings, grows your balance at the same time. No minimums, no limits - only unparalleled benefits.- No minimum balance

- No monthly fee

- Competitive dividends paid on your deposits*

- Overdraft Protection** and Overdraft Privilege***

- Free Visa debit card that you can connect to your mobile wallet for quicker, more secure transactions

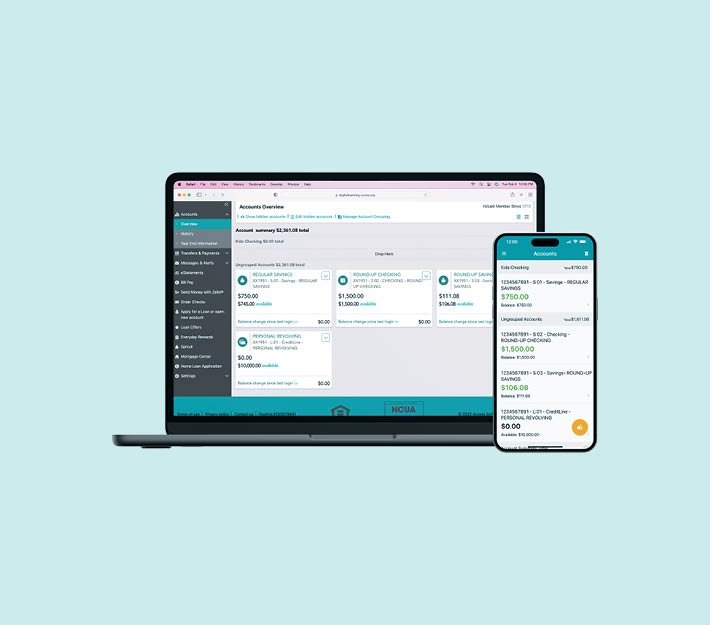

- Unlimited access to Digital Banking and Mobile App****

- Withdraw money at a nationwide network of 135,000 surcharge-free ATMs

- Reorder checks easily through Deluxe

* Rates are variable and subject to change after account opening. APY (Annual Percentage Yield) varies and is tiered based on meeting the following criteria: enrollment in eStatements, 20 monthly debit card transactions, and an open loan. Other rates are available and are based on account balance, requirements, and mentioned criteria for the 3 tiers. If the requirements are not met, your account will earn the standard APY. No minimum balance required to open or earn the APY. No monthly service charge. All loans subject to approval. Insured by NCUA.

It's our basic checking account. But it's far from stripped down to the bones. Perks include dividends on your deposits, a free Visa debit card, and state-of-the-art digital banking.

It's our basic checking account. But it's far from stripped down to the bones. Perks include dividends on your deposits, a free Visa debit card, and state-of-the-art digital banking.- No minimum balance

- No monthly fee

- Competitive dividends paid on your deposits

- Overdraft Protection* and Overdraft Privilege**

- Free Visa debit card that you can connect to your mobile wallet for quicker, more secure transactions

- Unlimited access to Digital Banking and Mobile App***

- Withdraw money at a nationwide network of 135,000 surcharge-free ATMs

- Reorder checks easily through Deluxe

* You can choose to have funds transferred from your savings account or additional checking account to cover amounts more than your available balance.

** Overdraft Privilege is a discretionary overdraft service, requiring no action on your part, that provides you a safety net up to an automatically assigned overdraft limit. Your Overdraft Privilege Intelligent limit may be available for checks and other transactions made using your checking account number, such as an automatic (ACH) payment transaction, automatic bill payment or recurring debit card payment. If you request us to do so (opt in), we may authorize ATM transfers or withdrawals and everyday debit card purchases using your available balance and your Overdraft Privilege limit. For business accounts the limit may be available for ATM and everyday debit card transactions with no action required. Balances displayed do not include the Overdraft Privilege limit. There is no additional cost associated with Overdraft Privilege unless you use it. If you do use the Overdraft Privilege limit, you will be charged our paid item OD Privilege fee of $32 for each overdrawn item created by checks and other transactions made using your checking account number, such as an automatic payment (ACH) transaction, automatic bill payment, or recurring debit card payment. For Overdraft Privilege consideration, your account is in “good standing” if you (1) make sufficient deposits to bring your account to a positive end-of-day balance at least once every 30 calendar days (including the payment of all credit union fees and charges); (2) avoid excessive overdrafts suggesting the use of Overdraft Privilege as a continuing line of credit; and (3) have no legal orders, levies or liens against your account.

*** Data and other wireless carrier charges may apply.

They say that hindsight is 20/20. If you had a second chance to have a checking account, what would you do differently? With our 20/20 Checking, you get a long list of features and an opportunity to get your finances back on track.

They say that hindsight is 20/20. If you had a second chance to have a checking account, what would you do differently? With our 20/20 Checking, you get a long list of features and an opportunity to get your finances back on track.- No minimum balance

- $10 monthly fee

- Free Visa debit card that you can connect to your mobile wallet for quicker, more secure transactions

- Access to Digital Banking and Mobile App*

- Opportunity to transition to a commonWEALTH Checking after one year**

- Other eligibility requirements apply. Please contact one of our Financial Service Representatives for more details to see if you qualify.

wait - there's more

All of these options. Also yours. Just another way to help you create the account experience that's uniquely yours.

YOUR MONEY, WHEN AND WHEREVER

Visa Checkout

Account-to-Account Transfers

OVER 135,000 Surcharge free ATMs nationwide

Exclusive Discounts

Protection comes standard

Scam artists and identity thieves seem to be everywhere these days. The best way to fight fraud? With a team effort.

Round up in action